Article: 50027

F8962-070

The IRS has rejected your return because their database indicates that someone on the return had health insurance coverage through the marketplace. You should have received Form 1095-A from the marketplace about this coverage. When you enter Form 1095-A, Form 8962 is generated when applicable. You will need to add this information to your return and re-file it.

Add Form 1095-A

To add this information:

- Click Federal Taxes > Review.

- Click I’d like to see the forms I’ve filled out or search for a form.

- In the search bar, enter 1095-A.

- Click Add form beside Form 1095-A Health Insurance Statement.

- Enter the information as shown on your 1095-A.

If Column B is blank and Column C has an amount, go to HealthCare.gov to get the Second Lowest Cost Silver Plan for Column B.

- Refile your return.

No Form 1095-A – Add Statement

If you did not receive Form 1095-A, review your insurance coverage and contact your insurance provider or the Marketplace to confirm that Advanced Premium Tax Credit was not paid for anyone on the return. After confirming this information, follow these steps to provide an explanation as to why Form 8962 is not attached.

- Go to My Return.

- Below the reject message, click Add an Explanation.

- On the Statement for the Premium Tax Credit Rejection, select the appropriate option, or click I have a different explanation to type your own statement.

- If you click I have a different explanation, select ACA in the drop list, enter your explanation, then click Save.

- Once you have selected or entered your explanation, you will be prompted to attach the explanation to your return as a PDF.

- Then you can e-file your return again.

PINTypeCd / PrimaryBirthDt / Birthday Entry Error

This message indicates that the IRS database is showing an error in one of your (or your spouse‘s) Name, Social Security Number, or Date of Birth in your Name and Address section. This error might be due to an entry error, or to the IRS having a different date on file. Please double-check your name, SSN, and date of birth (and that of any spouse/dependents you may have). If they are correct, you will need to contact the IRS at 1(800) 829-1040.

SSN Has Already Been Used Reject

From the sidebar menu, click Name & Address, and verify that the Social Security Number entered is correct. If you made a mistake, correct the SSN, and refile your return.

If the Social Security Number is correct, someone may have filed a return using your number. In this case, you must print and file your return by mail. We recommend that you also fill out and include Form 14039, Identity Theft Affidavit.

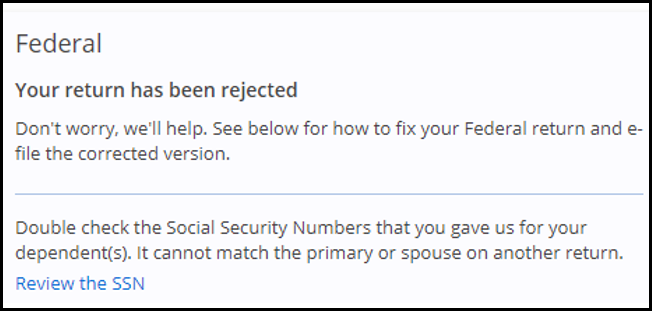

Dependent SSN Reject

When a dependent fails to indicate that they can be claimed as such on their return, the IRS will reject the return of the person who is attempting to claim them as a dependent. This is the rejection:

To allow the other person to claim them as a dependent, the dependent will need to amend their return and indicate that they can be claimed by someone else.

The IRS database can take a few months to be updated with amended return information. In this circumstance, the person claiming a dependent may not be able to e-file due to the same reject. To resolve this issue, choose one of the following options:

- Print and mail the return. See KB 50032 for details.

You may want to include a statement that you are paper-filing because the e-filed return was rejected due to the dependent claiming themselves, but the dependent has amended their return to show that you are claiming them.

- Request an extension (prior to the federal filing deadline). This will allow you to delay your filing until October 15 and give the IRS time to update their information.

1040.com does not receive updated information as to whether the IRS has updated their database. As such, you would need to re-file intermittently to see if the return can now be accepted.

Form 8862 Reject

If you have been previously disallowed a credit by the IRS, you will need to fill out Form 8862 and refile your return.

If you have any questions about the disallowance, or how to report it, you will need to contact the IRS directly. You can also use this link for more information about Form 8862: https://www.irs.gov/forms-pubs/about-form-8862

Adjusted Gross Income (AGI) Reject

See Adjusted Gross Income (AGI) for details.

IP PIN Reject

See Entering an Identity Protection Pin (IP PIN) for Taxpayer, Spouse, or Dependent for details on recovering and entering your IP PIN to resolve this reject.

Contact IRS

You can contact the IRS at: 1 (800) 829-1040.

The hours of operation are 7 AM – 7 PM local time Monday-Friday

You can also locate and contact your local IRS office: http://www.irs.gov/uac/Contact-Your-Local-IRS-Office-1

If you need to contact a Taxpayer Advocate, use http://www.irs.gov/Advocate/Local-Taxpayer-Advocate to locate the phone number and address.