Article: 50071

You will receive Form 1099-R from each person from whom you have received a designated distribution – or are treated as having received a distribution – of $10 or more from:

- Profit-sharing or retirement plans.

- Individual retirement arrangements (IRAs).

- Annuities, pensions, insurance contracts, survivor income benefit plans.

- Permanent and total disability payments under life insurance contracts.

Basic Entries

To enter information for pension or annuity income, Form 1099-R, to your return:

- Go to Federal Taxes.

- Click Review.

- Click I’d like to see the forms I’ve filled out or search for a form.

- Enter 1099R in the search box and add Form 1099-R – Pensions and Distributions.

- Enter your information and click Save.

For some pensions/annuities, you may need to select additional options. See below for details.

Special Situations

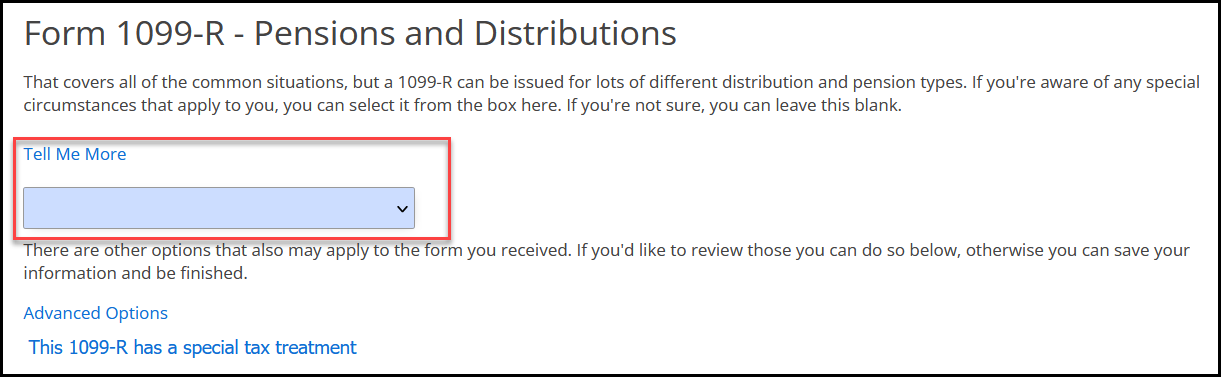

There are several special situations that change the way 1099-R disbursements are taxed. Review the full list of special situations by selecting it from the drop list below Tell me More before clicking Save. The statement type is not the distribution code listed on your form and is not required if any of the options do not apply.

Advanced Options

- Click Advanced Options to select or enter the following:

- 1099-R for disability

- Add this statement as additional taxes on my IRA, MSA etc.

- Exclude this statement from my income and I will report it as tax on lump-sum distributions.

- I need to use Form 8606 or ROTH to determine the taxable amount of this distribution; I don’t want to double the amount on Form 1040, line 4.

- This 1099-R has been altered or handwritten.

- If you received this distribution as the result of a life insurance contract or reportable death benefits you can add the date of payment here.

- If you are retired and need to include your retirement date with this statement, you can add that here.

- If you would like to exclude a portion of the funds from this statement from your state return, you can indicate that here. As a reminder, some states require this information.

- Tell us the portion of this 1099-R to exclude on your state return.

- What is the portion of this 1099-R that does not qualify for state exclusion?

- Click This 1099-R has a special tax treatment to enter details for:

- Simplified General Rule

- Qualified Charitable Distributions (see below)

- HSA Funding Distribution

- Public Safety Officers (PSO)

Enter the insurance premiums that are eligible for the PSO deduction in the box Insurance Premiums.

- State Rollovers or Exclusions (e.g., NY pension exclusion)

You may need to make additional entries on the state data entry as well.

- Ohio School District codes, distributions, and withholdings

If you make conflicting entries, you may not be able to e-file the return. For more information about pensions and annuities, use the Interactive Tax Assistant.

States or Military

Some states may allow an exclusion of pension or annuity income. You may need to enter the State Distribution amount on Form 1099-R Box 16 and/or manually exclude your pension by using the Advanced Options menu at the bottom of the page.

If you need to exclude pension income from the state or military pay, proceed through the form, and at the bottom, click This 1099-R has a special tax treatment.

For the state return to be eligible for e-file, you will need to enter a state distribution amount when there is a state withholding amount on your 1099-R. If there is no distribution amount, you will need to print the state return and paper file it. Most of the time, the state distribution amount is the same as the federal; however, you will need to verify this with the issuer of the form.

Zero (0) is not a valid entry for a state distribution, if you have state withholding. This would indicate that your state is withholding tax from zero income. If the entry is not present on your personal copy of the 1099-R, you need to reach out to the issuer and verify the amount.

Error – State Withholding, No Distribution

This message generates when you have provided state withholding information on Form 1099-R without a state distribution amount. This creates an error as it indicates you are paying tax on zero income. This error will also occur if you have entered the distribution but failed to select the state in the drop list. Review each Form 1099-R to ensure that the State (box 15), State Distribution (box 16), and State tax withheld (box 14) have been entered accurately.

Zero (0) is not a valid distribution amount.

If there is no amount recorded on the Form 1099-R for box 16, you will need to contact the issuer to verify the amounts. If there is no distribution amount available, you will not be able to clear the message and would need to paper-file the return.

First-Time Home Purchase

For 1099-R distributions used toward a first-time home purchase, enter a Distribution code of 1. See the Form 1099-R Instructions for details. These distributions are still subject to penalties.

Qualified Charitable Distribution (QCD)

To report your qualified charitable distribution from an IRA, you will want to follow the instructions below:

- Go to Federal Taxes.

- Click Review.

- Click I’d like to see the forms I’ve filled out or search for a form.

- Enter 1099R in the search box and add Form 1099-R – Pensions and Distributions.

- Enter your information, click This 1099-R has a special tax treatment and indicate how much of the distribution is considered a QCD.

- Click Save.

The limit per person is $100,000. If 1099-R is entered as an IRA and Box 2 100% QCD up to $100,000 is marked, only amounts more than the $100,000 will flow to Form 1040. A Qualified Charitable Distribution (QCD) is a nontaxable distribution made directly from an IRA by the trustee.

Per Publication 590, you cannot claim a charitable contribution deduction for any QCD not included in your income.

60 Day Rollover

Enter the date of payment or when the funds were withdrawn from the 401(k) in box 13 of Form 1099-R. That is the date the IRS uses to determine whether the funds were deposited within 60 days.

Required Minimum Distributions (RMD)

Enter your Required Minimum Distribution (RMD) amount on Form 5329. Complete the form as applicable, then click the check box Part IX – Minimum Required Distributions. Enter the necessary information in the RMD field, then click Save.