Article: 50086

Overview

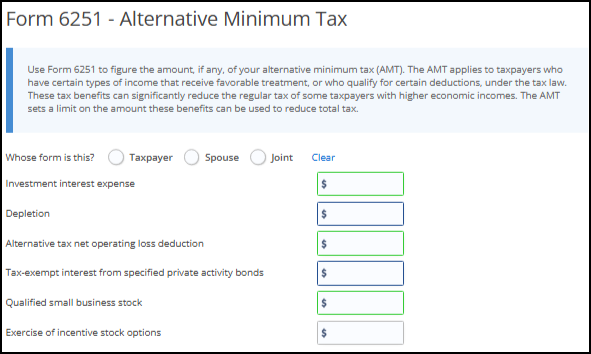

Form 6251 is used to determine whether a taxpayer is subject to the Alternative Minimum Tax (AMT). The AMT is designed to ensure that individuals with higher economic incomes—who benefit from certain tax advantages—pay a minimum level of tax.

This form applies to taxpayers who:

- Have types of income that receive favorable treatment under the tax law.

- Qualify for specific deductions that may significantly reduce their regular tax liability.

The AMT limits how much these tax benefits can reduce your total tax obligation. For official guidance, refer to the IRS Instructions for Form 6251.

If Form 6251 is required, the software will automatically generate and calculate amounts on the relevant lines according to IRS instructions.

How to Add Form 6251

To add Form 6251 – Alternative Minimum Tax to your return:

- Go to the Federal taxes section.

- Click on the Review tab on the left-hand side.

- Select I’d like to see the forms I’ve filled out or search for a form.

- In the search box, enter Form 6251 or go to the Taxes tab.

- Click on Form 6251 – Alternative Minimum Tax to open the form.

- Fill in the applicable information.

- Click Save to apply changes.

Field Entry Guidelines

- Green Fields: Represent override fields.

- Manually entered amounts in these fields will override the system-calculated value for that line.

- Blue Fields: Represent adjustment fields.

- Entries in these fields will either:

- Add to the calculated amount (if entered as a positive value).

- Subtract from the calculated amount (if entered as a negative value), based on IRS instructions.

- Entries in these fields will either: