Article: 50180

Overview

If you were previously denied eligibility to claim certain tax credits and have claimed them on your current return without including Form 8862, your return will be rejected by the IRS. This article provides an overview of the rejection and outlines the steps required to resolve the issue.

Form 8862 Overview

Taxpayers complete Form 8862 and attach it to their tax return if:

- Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

- They want to take the credit(s) this year AND meet all the requirements.

The Rejection Message

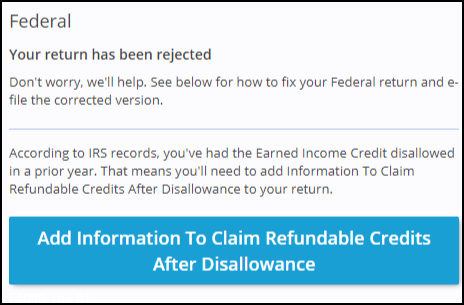

While the text will change based on which credit you previously had disallowed, the rejection message will look like this:

How to Add Form 8862 to Your Return

Complete the following steps:

- Click Federal Taxes > Review > I’d like to see the forms I’ve filled out or search a form.

- Search for Information to Claim Refundable Credits After Disallowance and click add form.

- Complete the form with your applicable information.

- Click Save.

Necessary Information

If you meet the eligibility criteria outlined above, you will be required to provide the following information in order to complete Form 8862:

- Identify the credits that were previously disallowed.

- For purposes of the Earned Income Credit (EIC):

- If your prior EIC claim was disallowed, was the disallowance due to the misreporting of earned or investment income?

- Are you or your spouse eligible to be claimed as a qualifying child by another taxpayer for the current tax year?

- If you are claiming a qualifying child:

- How many days did the child reside with you in the United States?

- If claiming multiple qualifying children, a separate Form 8862 must be completed for each.

- How many days during the tax year was your principal residence located within the United States?

- If filing jointly:

- How many days during the tax year was your spouse’s principal residence located within the United States?