Article: 50039

Date of Death

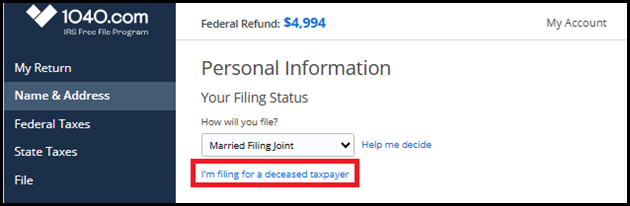

Taxpayer

The date of death is entered on the Name and Address screen. Click the link under Filing Status that says, I’m filing for a deceased taxpayer. Then enter the taxpayer’s date of death.

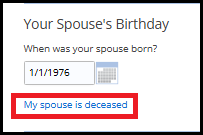

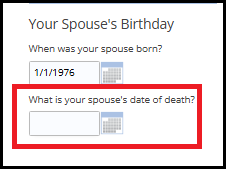

Spouse Date of Death

The date of death is entered on the Name and Address screen. Click the link under Your Spouse’s Birthday that says, My spouse is deceased. Then enter the spouse’s date of death.

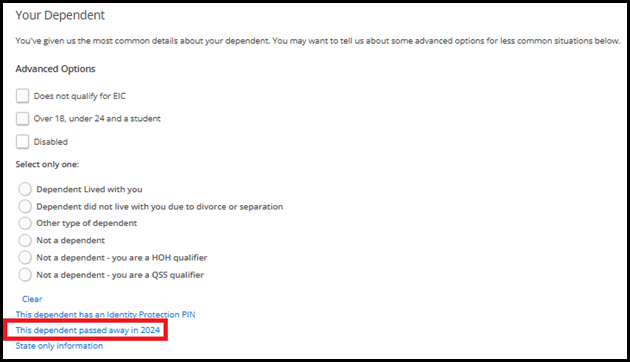

Dependent

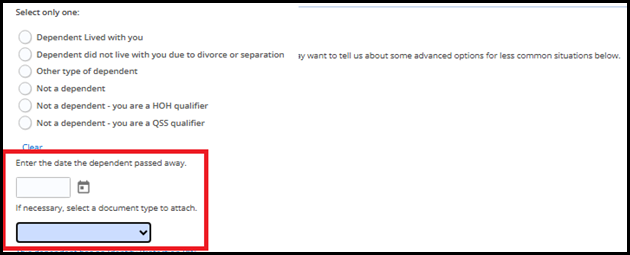

Go to Federal Taxes > Dependents. Under the section Your Dependent, click the link I’d like to see the advanced options for this dependent.

Click on the hyperlink This dependent passed away in to enter in the date of death.

If you need to attach additional information regarding the dependent’s death, you can select the specific form you are attaching in the drop list If necessary, select a document type to attach.

- A – Birth Certificate

- B – Death Certificate

- C – Hospital medical records

Filing on behalf of a deceased taxpayer

The executor (usually named in the will), administrator, or anyone else in charge of the decedent’s property is considered the personal representative.

The personal representative is responsible for filing any final tax returns (and the estate tax return of the decedent) when due.

You may need to file Form 56 (Notice Concerning Fiduciary Relationship) to notify the IRS that you will be filing on behalf of someone else. For more information on personal representative responsibilities, refer to IRS Publication 559.