Article: 50063

Form 1099-C, Cancellation of Debt, is a tax form issued by creditors to report the cancellation or forgiveness of a debt of $600 or more. The IRS considers this amount as potential income that needs to be reported on your tax return.

To enter information for Form 1099-B, for proceeds from broker and barter exchange transactions or sales of assets:

- Go to Federal Taxes

- Click Review.

- Click I’d like to see the forms I’ve filled out or search for a form.

- Enter Debt in the search box and add 1099-C – Debt Cancellation.

- Enter your information and click Save.

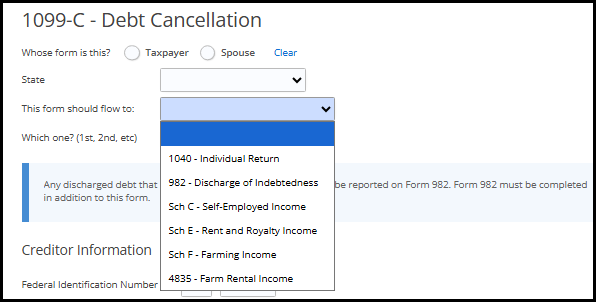

If the amount is a discharged debt that is excludable from gross income, it should also be reported on Form 982.

For further information on cancellation of debt and assistance with determining if it is taxable or nontaxable income see IRS Tax Topic 431 and Publication 4681.