Article: 50001

View or edit account information

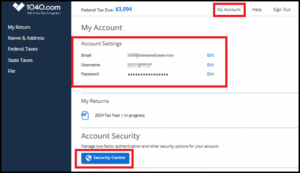

You can view and edit your account information on the My Account page of 1040.com.

Under Account Settings, you can edit your Email, Username, and Password, as desired.

In the Security Center section, you also have the option to configure two-factor authentication, add or remove trusted devices, and change your security questions.

See Site Security, Security Questions, and Two-Factor Authentication (2FA) and Recover Your Username or Reset Your Password for details.

Delete account

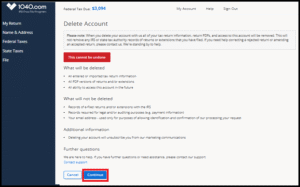

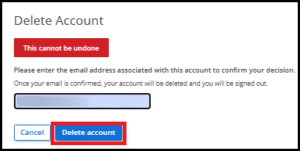

This process cannot be reversed.

To permanently delete your account:

- Log in to your 1040.com account.

- Click My Account.

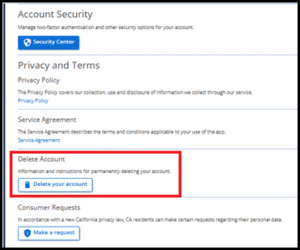

- Scroll to the bottom of the screen. Under Delete Account, click Delete your account.

- A warning appears. If you wish to proceed, click Continue.

- Enter the email address associated with the account to confirm your decision and click Delete account.

Deleting your account does not delete any returns that have already been e-filed.

Account blocked

1040.com is meant for individual taxpayers to use to prepare their own tax returns. This is why we limit the number of returns that can be filed from a single computer. If we can verify that the computer is in a public place, such as a public library, we will consider relaxing the policy for that specific computer.

Merge two accounts

It is not possible to merge two accounts.

Locate my return

If you do not see your current return under My Account, make sure you are using the correct username when logging in. 1040.com allows up to five accounts (usernames) to be associated with a single email address.

Import data from another site

You cannot import tax data from another website or account. You must manually enter all necessary data where needed.

If you used 1040.com last year, we will auto-fill as much information as possible following federal and state guidelines.

Get support

See Contacting Support for options.

Using website outside the United States of America

Due to security precautions and data privacy regulations, our site no longer allows access from most foreign countries. This may apply to countries from which filing was possible in prior years.

Third Party Designee

Currently, you cannot add a third-party person to discuss your federal 1040 or state tax return on your behalf through our system.