Article: 50090

Overview

Form 8283 is used to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. For further information and guidance on reporting, see: https://www.irs.gov/instructions/i8283.

How to Add Form 8283

To add Form 8283 – Noncash Charitable Contributions to your return:

- Go to the Federal taxes section.

- Click on the Review tab on the left-hand side.

- Select I’d like to see the forms I’ve filled out or search for a form.

- In the search box, enter Form 8283 or go to the Taxes tab.

- Click on Form 8283 – Noncash Charitable Contributions to open the form.

- Fill in the applicable information.

- Click Save to apply changes.

Error Message Troubleshooting

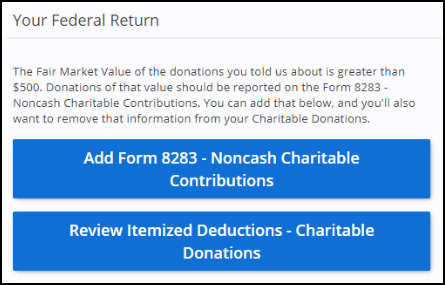

In certain instances, after adding Form 8283 for Non-Cash Charitable Contributions, an error message may appear indicating that the form is still required.

This error occurs when the system interprets the amount entered on the Itemized Deductions – Charitable Donations form as an additional contribution, separate from the amount reported on Form 8283.

If the non-cash charitable contributions exceed the threshold that requires the completion of Form 8283, remove the corresponding amount from the standard Itemized Deductions – Charitable Donations form. To do this, change the response to the question “Did you make any non-cash donations?” from “Yes” to “No.”