Article: 50055

Overview

Eligibility for the Earned Income Credit (EIC) is calculated based on the entries you make when adding a dependent (Federal Taxes > Dependents) and on the other information you enter in the return.

Elections

There may be a circumstance when you need to make an Earned Income Credit election. such as qualifying for EIC, but they do not wish to claim the credit. Most taxpayers will not need to make one of these elections, but for those that do need to make one of the specified elections for Earned Income Credit they will do so by following the steps below.

To find the Earned Income Credit Elections:

- On the left, click Federal Taxes then Review.

- Click the link I’d like to see the forms I’ve filled out or search for a form.

- Click on the Credits tab.

- Click on Earned Income Credit Elections to add and open the form.

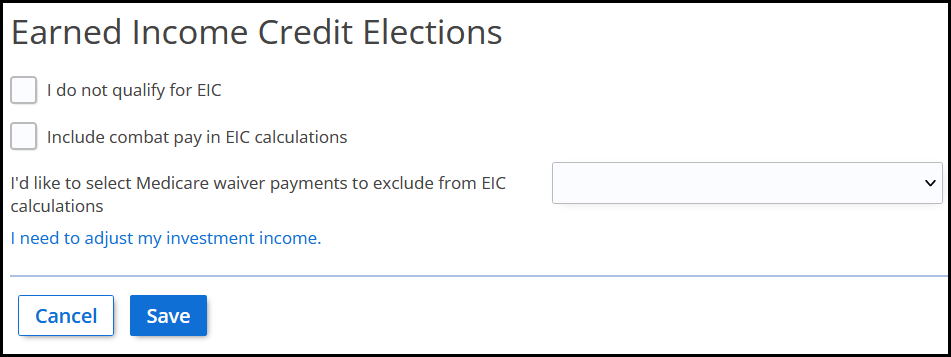

- Select one or more of the following options:

- I do not qualify for EIC

- Include combat pay in EIC calculations

- I’d like to select Medicare waiver payments to exclude from EIC calculations

- Exclude taxpayer’s Medicare waiver payments only

- Exclude spouse‘s Medicare waiver payments only

- Exclude taxpayer’s and spouse’s Medicare waiver payments

- I need to adjust my investment income

To subtract investment income, enter in the amount you wish to subtract as a negative. To add to your current investment income, you will enter in the amount as a positive.

- Click Save.

Married Filing Separate (MFS)

Earned Income Tax Credit may be available to otherwise eligible individuals who file a Married Filing Separate (MFS) return. This may apply to you if you lived with your dependent child for more than half of and separated from your spouse by the end of the year. The latter requirement means you either lived apart from your spouse for the last 6 months of the year or simply lived apart by the end of the year and had a decree or written separation agreement.

To select that you are eligible for this:

- On the left, click Federal Taxes then Review.

- Click the link I’d like to see the forms I’ve filled out or search for a form.

- Click on the Credits tab.

- Click on Earned Income Credit Married Filing Separate.

- Click Next.

- Answer the question Did you live with your qualifying child for more than 6 months during 2024?.

- If you answer Yes, you will be prompted to answer the next question: Did you live apart from your spouse at the end of 2024?.

- If you answer Yes, you will be prompted to select the applicable option:

- I lived apart from my spouse for the last 6 months of 2024.

- I no longer lived with my spouse by the end of and have a Decree of Separate Maintenance, written separation agreement, or a decree requiring support or maintenance payments.

- Click Save.

If you answer No to either question detailed above, you will see a note that your situation does not qualify. Click Save.