Article: 50034

If you need to update or correct your return after it has been filed and accepted, you will need to generate and file Form 1040-X. If it has not been accepted, you can correct the return and file the updated Form 1040 instead.

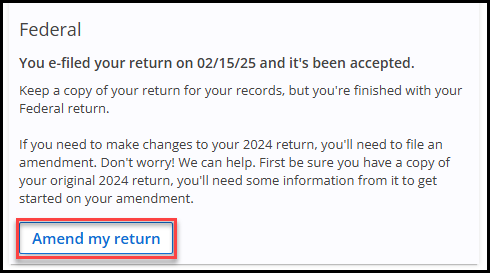

If the return has not been accepted through 1040.com, you will not be able to access the amended return link (highlighted below):

Amending Your Return

- Download a copy of your originally filed return. You will need this for reference while creating your amended return. To do so,

- Click My Account, then click the PDF icon next to the tax year of the return.

- This will open the PDF of your filed return in a new window. You can also print it at this point.

- Click My Return in the left sidebar, then click What if I need to make changes now that my return is accepted?.

- Click Amend my return.

- Click Next.

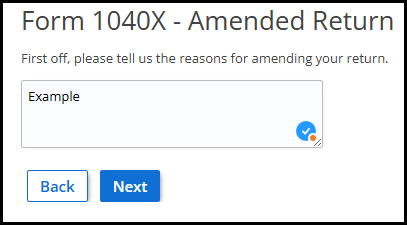

- Enter the reason why you are amending your return, then click Next.

- Proceed by entering the requested information from your original return on the screens that follow. Line numbers are included for your convenience, where applicable.

Make sure that you are entering your ORIGINAL information on this page. You will provide your updated information later – Form 1040-X is used for reporting ORIGINAL return information only.

- At the end of the interview process, a message confirms that you have provided the necessary data. Click Save.

- Now that you have added your original information, the Federal Refund at the top of your account will show as $0. From here, this information will be updated as you start to enter your corrections. If an additional refund, or amount due is calculated, it will be shown at the top as you move through the process.

For example, if you previously had a tax due amount, and after making your corrections, you are showing a refund now, that is a refund relative to your original return. So, if you previously owed $200, and are now showing a refund of $50, you would have an overall tax due amount of $150 if you had accurately reported all details when filing originally.

- Now, proceed by adding or removing information. The original forms are still completed, so you will need to review each form, correcting the information needed. If a new form needs to be added, do so at this time. You can also delete forms, if entered accidentally. See Completing Forms – A Step-by-Step Guide for more information about adding, editing, or deleting forms.

- Once you have made the necessary corrections, additions, or deletions, you will file the amended return the same way you filed your original return. See Filing a Return for more detailed information about filing.

Your amended return is ready to file whenever there are no errors on the return. If you still have corrections to make, that is okay – you can still make them before filing.

Frequently Asked Questions

Can I file another amended return after I have already amended my return?

You can prepare a second amended return in your account, but it must be printed and mailed. Our software allows you to e-file only one amended return per account. Any additional amendments must be submitted by mail.

Can I amend a return I filed on elsewhere (different website or with a preparer)?

No. Our software requires that your original return was filed and accepted through us. Without that, the option to add Form 1040-X won’t be available.

Can I amend my state return?

You are not able to file an amended state return using 1040.com. If you need to amend a state return, you will need to do so through your state’s Department of Revenue or Taxation website.

Can your software help me calculate my state amendment?

You can make changes in your return and generate a preview of the updated state return, but you’ll need to file it manually based on your state’s requirements.

How do I edit my Form 1040-X?

Click the Amend my return button on the My Return tab to return to your amendment. Make sure to click Save at the bottom when you’re done editing.

How do I remove an amended return?

If you decide that you don’t need to amend your return for whatever reason, you can remove the Form 1040-X you added and revert your return to how it was in when you filed it originally.

- Click on the My Return tab in the left sidebar, then click I don’t need to amend my return.

- Click OK, and your return will revert to how it was originally filed.

If you added or removed any forms, you would need to add or remove any forms that were changed in the steps above.

How do I print my amended return?

After filing:

1. Go to the My Account tab.

2. Under My Amended Returns, click the PDF icon next to the return you want to print.

Do I have to pay again to file an amended return?

No. Amended returns are included in the cost of your original filing.

How can I check the status of my amended return?

You can check the status at the IRS site: Where’s My Amended Return

Do I need to mail my amended return?

• If e-filing the first amendment: Do not mail it — doing both may delay processing.

• If filing a second amendment: You must mail the return as e-filing more than one Form 1040-X through is not available.

Do I need to amend a rejected return?

No. If your return was rejected, just correct the issues and re-file. Amendments apply only to accepted returns.

Do I need to amend my return if the IRS made a correction?

No, if the IRS made the correction, you do not need to file Form 1040-X. If you find an issue they didn’t catch, you should file an amendment.

Can I amend a prior-year return on 1040.com?

No, you can only amend the current year return. Amending a prior year return is not available on this site.