Article: 50052

Kentucky State ID numbers are required for all forms for Kentucky filers. You will see an alert or error if you fail to enter a state ID that meets the KY requirements. This may occur on one or more of the following forms:

- Form W-2

- Form W2-G

- Form 1099-G

- Form 1099-R

- Form 1099-DIV.

Alert

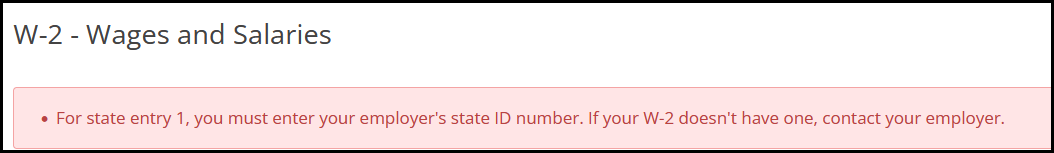

If you select Kentucky as the state when entering a form, but do not enter the State ID number, you will see the following red notice:

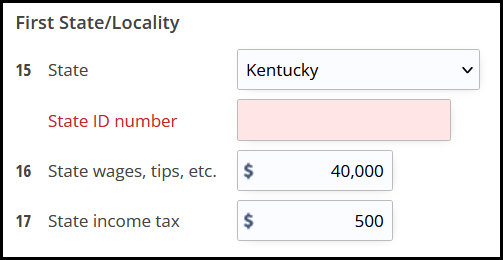

The field is highlighted so you can easily locate the missing entry:

Error

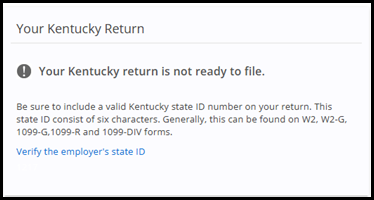

If you make an entry, but it is not in the valid format, when you go to the File tab and click Finish my Kentucky return, you will see the following message:

To clear this message, follow these steps:

- Click Verify the employer’s state ID.

- Click I’d like to see the forms I’ve filled out or search for a form.

- Review each Federal Form that reports Kentucky income and/or withholding.

- Enter the Kentucky State ID number exactly as it is shown on the form that you received and click Save.

Requirements

- If there is no ID on the form that you received, confirm the ID information with your employer/payer before you proceed.

- If there are leading zeros (0) or letters (e.g., “000123456” or “KY123456”), only enter the values that appear after the leading zeros or letters.

- Kentucky state ID numbers are a maximum of six (6) digits in length. In some cases, there may be fewer than six digits, but never more than six.

- If your state ID does not match the formatting provided above, reach out to your employer/payer to confirm the ID information before you proceed.

- If the issuer confirms that no value is available, you can enter “000000” to clear the error message.