Article: 50056

Overview

Pennsylvania does not have Head of Household as a filing status. Here are the four Pennsylvania filing statuses:

- Single (S)

- Married Filing Jointly (J)

- Married Filing Separately (M)

- Final (F).

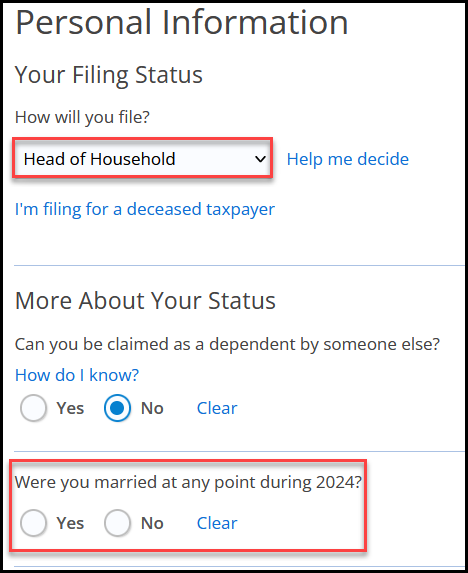

If you are filing your federal tax return as Head of Household (HOH), you will need to choose either Single (S) or Married Filing Separately (M) on your PA return, depending on your situation. When you select Head of Household for your federal return (Name & Address screen > How will you file? drop down), you have to answer the question: Were you married at any point during 2024?

.

- If you answer No, your PA filing status will be set to Single (S), and you will be able to file your state return electronically without any issues.

- If you answer Yes, your PA filing status will be set to Married Filing Separately (M), however, since no spouse information is required on the federal return for this selection, PA Error 0079 will generate preventing you from e-filing the PA return.

Resolving PA Error 0079

You have two options that you can use to resolve PA Error 0079.

File Federal then PA

- If HOH is accurate for federal, you can file your federal return first, using the HOH status for federal only.

- Once it has been accepted, go back to the Name and Address section.

- Change the filing status to Married Filing Separate.

- Enter your spouse’s information.

- e-File your PA return as Married Filing Separately.

Paper-file PA

- Complete and pay for your return.

- Go to the My Account tab.

- Under My Returns, click on the PDF icon to generate a copy of your completed return.

- Click View Return.

- Print your return.

- Paper-file the PA return.

Visit the PA DOR for address details.